[ad_1]

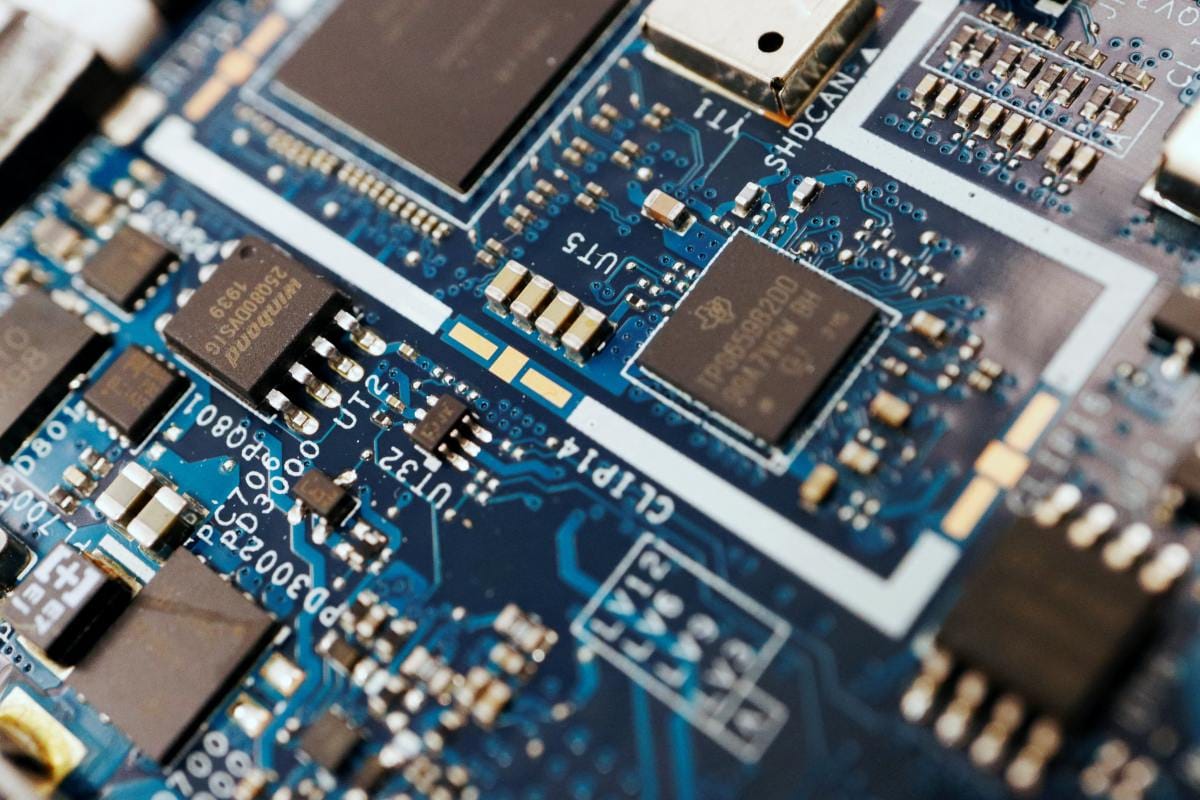

A supply chain crisis triggered by the global pandemic deprived makers of PCs and smartphones to cars of computer chips needed to make their products.

All that suddenly changed over three weeks from late May to June, as high inflation, China’s latest COVID-19 lockdown, and the war in Ukraine dampened consumer spending, especially on PCs and smartphones.

Chip shortages turned into a glut in some sectors, taking Wall Street by surprise. By late June, memory chip firm Micron Technology said it would reduce production. The market reversal caught Micron off guard, admitted Chief Business Officer Sumit Sadana.

As US chip earnings reporting season kicks off later this month, TechInsights’ chip economist Dan Hutcheson warned of more bad news following Micron’s grim forecast. “Micron kind of plowed the ground, with their honesty,” he said.

Worries about an industry downturn have slammed chip stocks, with the Philadelphia Semiconductor index tumbling 35 percent so far in 2022, far more than the S&P 500’s 19 percent loss.

Hoarding is making it worse.

Like nervous shoppers raiding supermarket aisles for toilet paper ahead of a COVID-19 lockdown, manufacturers stockpiled computer chips during the pandemic. Before that, “just in time” manufacturing was the norm for fiscally conservative companies, which ordered parts as close to production time as possible to avoid excess inventory, reduce warehouse capacity and cut upfront spending.

During the pandemic that shifted to what some jokingly call a “just in case” practice of stockpiling chips.

“Hoarding is a sign they think it’s essential until one day they look at it and say, ‘Why do I have all this inventory?'” said Hutcheson, who has been forecasting chip supply and demand for over 40 years. “It’s kind of like toilet paper.” The big chip U-turn has hit unevenly across business sectors, experts said.

Big suppliers of chips to consumer electronics makers, especially low-end smartphones, will be hit hardest by the downturn, said Tristan Gerra, Baird’s senior analyst for semiconductors. Nvidia, the design giant whose graphic chips are used for gaming and mining cryptocurrency, could see “another shoe drop” as prices continue to fall, exacerbated by the recent cryptocurrency market crash, Gerra said.

Among those least affected by a glut are Apple’s suppliers such as the world’s top chip factory Taiwan Semiconductor Manufacturing Company, said Wedbush analyst Matt Bryson. Demand remains high for Apple devices, which are more upmarket. Chipmakers supplying automotive and data centres will also thrive, said Gerra, noting unabated demand.”In power management, we’re going gangbusters,” said an executive of another global chipmaker who asked not to be identified.

However, for radio frequency chips used in smartphones, “we’re seeing a pullback because of handsets,” he added.

The executive’s chip factory is “retooling” production lines to make more power management chips for cars and fewer RF chips, which could eventually help relieve some of the auto chip shortages, he said.

While industry executives and analysts cannot say how many excess chips are in warehouses around the world, first-quarter inventory hit a record high at key electronics manufacturing services companies, said Jefferies’ analyst Mark Lipacis in a July 1 note. The previous first-quarter record was over two decades ago, right before the dotcom bubble burst.

Manufacturers may decide to use up chips in warehouses instead of buying new ones, and cancel orders, Lipacis warned.

Auto chipmakers are safe for now, some analysts said. But that may not last long.

In his September note, Bernstein analyst Stacy Rasgon said automakers were ordering far more chips than they appeared to need, and that trend is continuing, he told Reuters.

That will create a problem when vehicle makers stop buying chips to use up their stockpiles.

© Thomson Reuters 2022

[ad_2]

Source link